Simplify Life With An

All-In-One Social Media App

Remember the days when you only needed one social media app to stay connected? Jabburr aims to bring that simplicity back

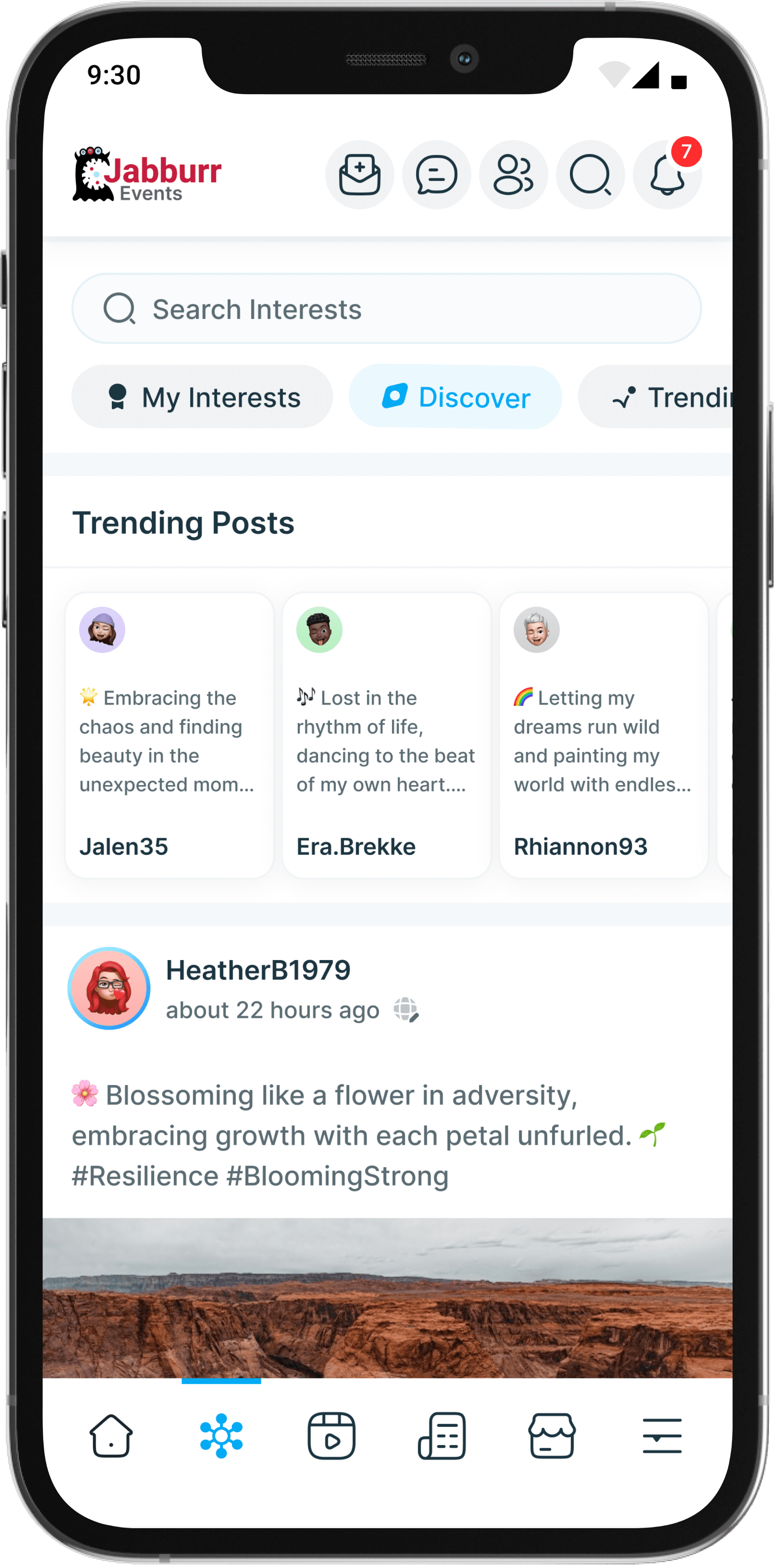

No Privacy TrackingBuy & Sell Directly On JabburrAbundant MonetizationAdvertise With 80%-90% Less Cost

Twitter like feed

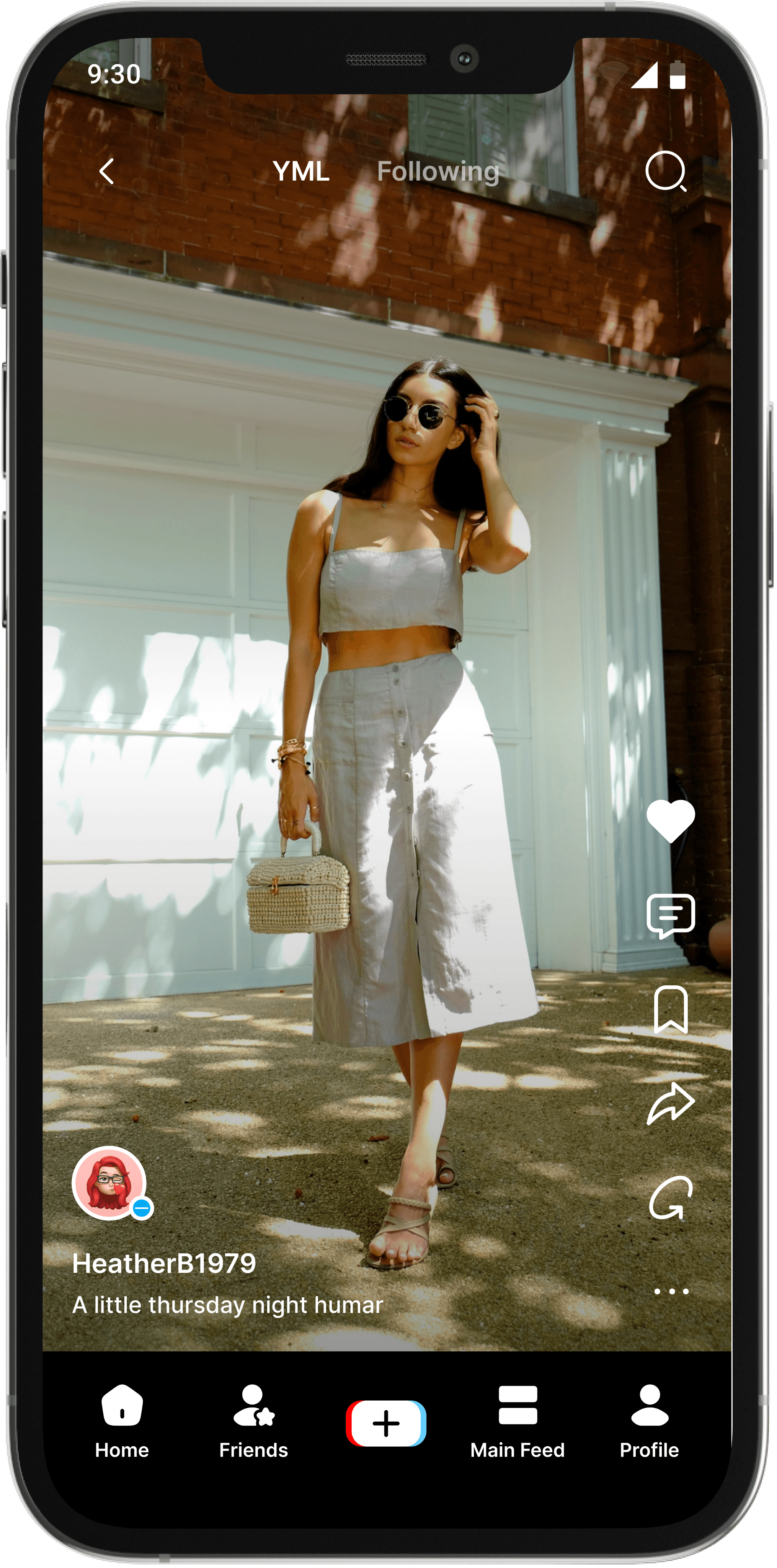

Tiktok like feed

Facebook like feed